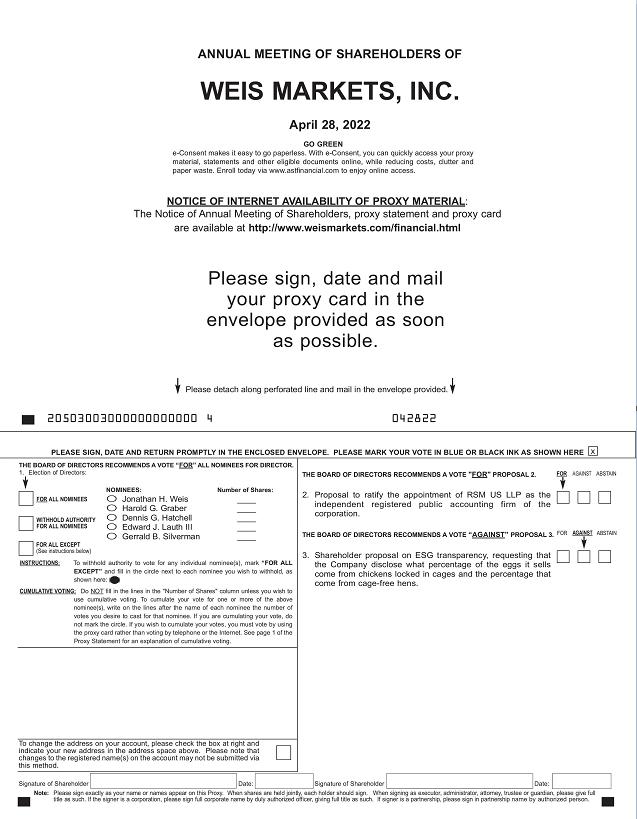

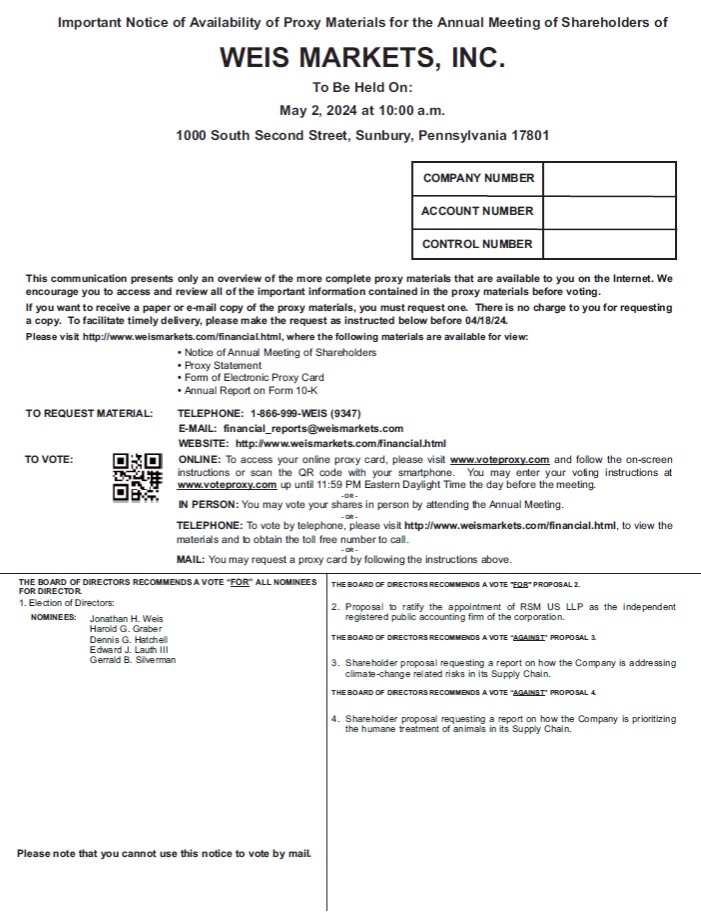

PROPOSAL NO. 4

THE HUMANE SOCIETY OF THE UNITED STATES

SHAREHOLDER PROPOSAL

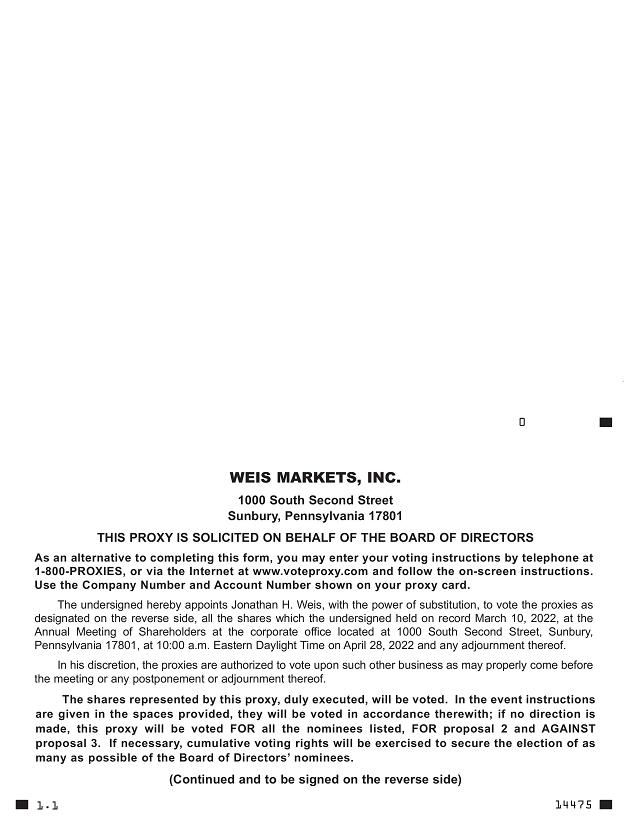

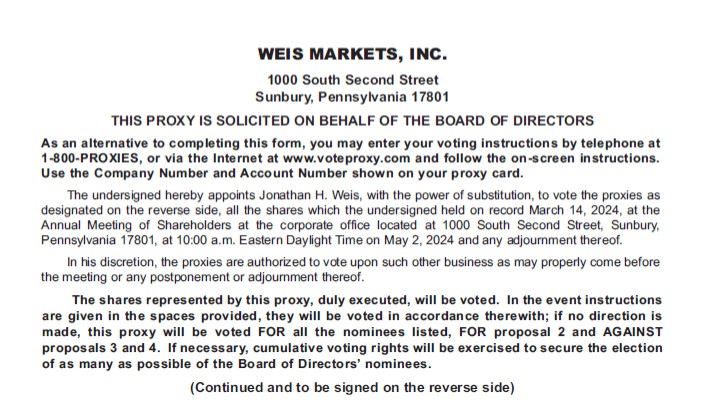

The Company has been notified that The Humane Society of the United States, 1255 23rd Street NW, Suite 450, Washington, DC 20037, the beneficial owner of at least $2,000$25,000 in market value of the Company’s common stock on the date the proposal was submitted and for at least the preceding eighteen months,one year, intends to present the following proposal at the 20222024 Annual Meeting of Shareholders. In accordance with applicable proxy regulations, the proposal and supporting statement, for which we and our Board accept no responsibility (including the sources referenced therein), are set forth below:

Shareholder Proposal on ESGSeeking Transparency

This proposal simply calls for disclosure from Weis Markets about

Weis’ 2022 proxy statement proclaimed to shareholders that “Supporting the company’s progress implementing one of its longstanding ESG promises.

As background: since 2016, Weis’ website has stated its goal to “convert its entire egg category to be 100 percent cage-free by 2026.” It further specifies that: “In the coming years, we will be working with our locally-based egg suppliers to implement our program.”

This commitment addresses the extreme confinement of hens in cages so cramped, the animals are prevented from even spreading their wings. Caged hens have even been found living with the mummified carcasses of their dead cage-mates. The abuse is so cruel, that many states have *outlawed* the sale of eggs from caged hens.

To be certain, Weis’ commitment makes good business sense, as thehumane treatment of animals in our supply chain remains an important priority for the Company.”

Indeed, that would make sense since, beyond its ethical implications, animal welfare has long been recognized as posing material risks.

For example, Citigroup called “concerns over animal cruelty” a “headline risk” imperiling food companies. “In the case of animal welfare,” reported the World Bank’s International Finance Corporation, “failure to keep pace…could put companies and their investors at a competitive disadvantage.” And Walmart found 77% of shoppers would trust a retailer more that practiced humane livestock treatment.

And the fact that Weis included this assurance in its proxy statement serves as a strong starting point from which to examine the issue, given the particular rules requiring accuracy in proxy materials. But, while broad ethical proclamations are important, even more important is that Weis concretely demonstrate both the scope of, and actions to further, its welfare efforts.

Yet Weis hasn’t published these details, nor any overarching animal welfare policy. By contrast, many major food retailers transparently publish such policies, including Walmart, Albertsons, Kroger, Ahold Delhaize, Target, Aldi, Wegmans, Publix, Ingles, Sprouts, BJ’s Wholesale, Costco, Giant Eagle, Wakefern, and HEB.

Beyond its lack of general animal welfare policy, Weis has only ever announced one specific animal welfare commitment: in 2016, it pledged to exclusively sell cage-free eggs within a decade. But strangely, it’s refused to disclose any measurable progress toward that goal.

Given animal welfare’s ethical and material importance—and that Weis used its proxy statement to publish its new assurance about prioritizing the issue—it’s essential the company provide clear and complete transparency that demonstrates meaningful efforts to define and advance its position statement.

Indeed, animal welfare transparency is a significant socialreasonable request.

As the 2023 “Transparency Trends” report from FMI (an industry trade group with Jonathan Weis on its Board) found, it’s “extremely important” to the vast majority of shoppers that companies are transparent about products, with 74% saying that means providing “values-based information such as animal welfare.”

And a 2023 Merck study found that for 66% of consumers, both “transparency in animal proteins” and “animal care/treatment” itself are “extremely or very important.”

THEREFORE: Shareholders ask that within six months, Weis issue that can materially impact food companies:

| ● | Walmart found 77% of its shoppers will increase their trust and 66% will increase their likelihood to shop at a retailer that improves animal welfare (as reported by the Associated Press). |

| ● | Costco reports that “Failure to effectively respond to changing consumer tastes, preferences (including those relating to animal welfare) and spending patterns could negatively affect the demand for our products and services and our market share.” |

| ● | Northern Trust—a Weis shareholder with $1 trillion in assets under management—reports that it, “generally votes for proposals requesting increased disclosure or reporting regarding animal treatment issues.” |

| ● | Glass Lewis reports: a company “should consider its exposure to regulatory, legal and reputational risk due to its animal welfare policies and practices.” |

| ● | “In the case of animal welfare,” reported the World Bank’s International Finance Corporation, “failure to keep pace could put companies and their investors at a competitive disadvantage.” |

But serious concerns have arisen about Weis’a report explaining the details of how, precisely, it’s prioritizing “supporting the humane treatment of animals in our supply chain.” This should include all animal welfare promises.

For context, other food companies commitments, standards, requirements, and policies Weis has for its supply chain (both general and specific)—with similar pledges have disclosed their progress and/or steps they’re taking to reach their goals. Just some include Walmart, Sam’s Club, Kroger, Target, Nestle, Unilever, Kraft Heinz, Campbell Soup,details about when it adopted each one, and McDonald’s. Costco, for example, has disclosed that over 93% of the eggs it sold in FY 2020 came from cage-free hens.

By contrast, since first making its cage-free promise, Weis hasn’t disclosed any steps it has taken (or will take) to reach the goal—nor what progress, if any, it has made.

Any shareholder who finds value in a company’s ESG practices ought to favor this proposal, which simply asks for added transparency around a longstanding ESG commitment.